Table of Contents

ToggleXintao Goes Deep into Overseas Markets-United Arab Emirates

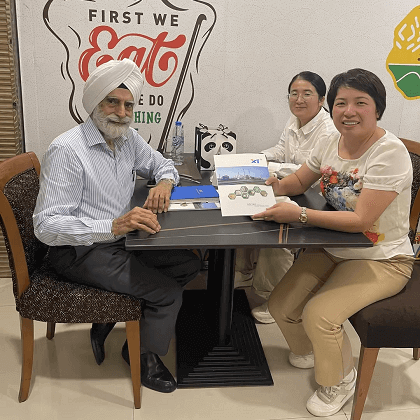

On November 2, the Xintao Technology team set off for the UAE to gain an in-depth understanding of the Middle East market. The UAE is a country with a large gap between the rich and the poor. The rich areas are mainly concentrated in the city center, and the civilian areas are concentrated in other areas of the city. There are also a large number of foreign populations, accounting for 90% of the total population, of which Indians account for 40%, Pakistanis account for 20%, Europeans account for 10%, Chinese account for 5%, and other countries account for 15%.

Business Environment

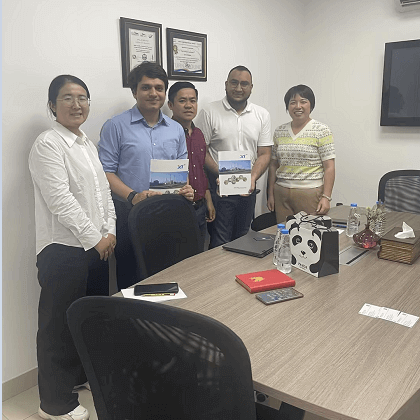

As an international trade center, the UAE exports 70% of its products abroad, and the market competition is fierce. The Xintao team stayed in the UAE for 7 days, during which time they visited 7 customers and participated in exhibitions with customers. For example, ADIPEC brings together oil and energy giants from all over the world, with a large passenger flow, which is an important platform for expanding business.

Market Situation

The market is relatively transparent, and some customers may turn to other countries or regions due to changes in the terminal market. The UAE market is highly competitive, and it is necessary to constantly pay attention to market trends and competitors and adjust market strategies in a timely manner. At the same time, because the weather in the UAE is dry and the highest temperature in summer is 55℃, the government has strict regulations on the storage of chemicals, which requires us to strengthen safety management in product transportation and storage.

Language and Culture

The UAE society is open and inclusive, with a high English penetration rate, and the elderly can also speak English, which provides convenience for our product promotion and market expansion.

Tax policy

According to customer feedback, we learned that UAE companies need to pay 5% VAT (value-added tax) and 5% tariffs when importing goods from China. Because the UAE and India have signed a trade agreement, UAE companies do not need to pay tariffs when importing products from India, but only need to pay 5% VAT (value-added tax). Goods imported from the free trade zone can be tax-free, and if sold to local companies in the UAE, the end user will pay the tax

In short, in the process of following up with UAE customers, we first need to understand the local cultural customs and business etiquette, and pay attention to local policy changes so that we can better communicate with customers, understand their needs and feedback during the communication process, and adjust market strategies and product solutions in a timely manner. Secondly, we need to improve service quality, provide high-quality after-sales service and solutions while ensuring product quality, and enhance customer stickiness. At the same time, we need to expand and utilize our customers’ business networks in the UAE and other countries overseas, actively expand overseas markets, and seek more cooperation opportunities.